Descarregue a nossa aplicação zondacrypto: discover crypto

app and start investing now!

O sistema jurídico estónio exige a implementação do Regulamento 2023/1114 de 31 de maio de 2023. No entanto, o atual sistema de licenciamento de criptomoedas estónio cumpre os requisitos legais e os mais elevados padrões éticos internacionais, prevenindo eficazmente o branqueamento de capitais e o financiamento do terrorismo.

A empresa, como entidade regulada pelo AML no mercado estónio, está sujeita a obrigações de auditoria nas áreas de conformidade e finanças perante o regulador AML estónio, a Unidade de Informação Financeira. Ambas estas áreas têm um impacto significativo na segurança das transações da bolsa e dos seus utilizadores, o que, sem dúvida, abrange o âmbito das auditorias obrigatórias da Empresa.

As auditorias acima mencionadas incluem:

A empresa reage dinamicamente às alterações legislativas. Como resultado da alteração da Lei AML da Estónia, implementou uma série de procedimentos internos que foram submetidos à verificação da UIF. Como resultado do acima exposto, a zondacrypto obteve uma atualização de licença. As estatísticas não deixam ilusões. À data da redação deste artigo, o número de entidades licenciadas é de apenas 47, enquanto o número máximo de licenças concedidas foi de 1.447.

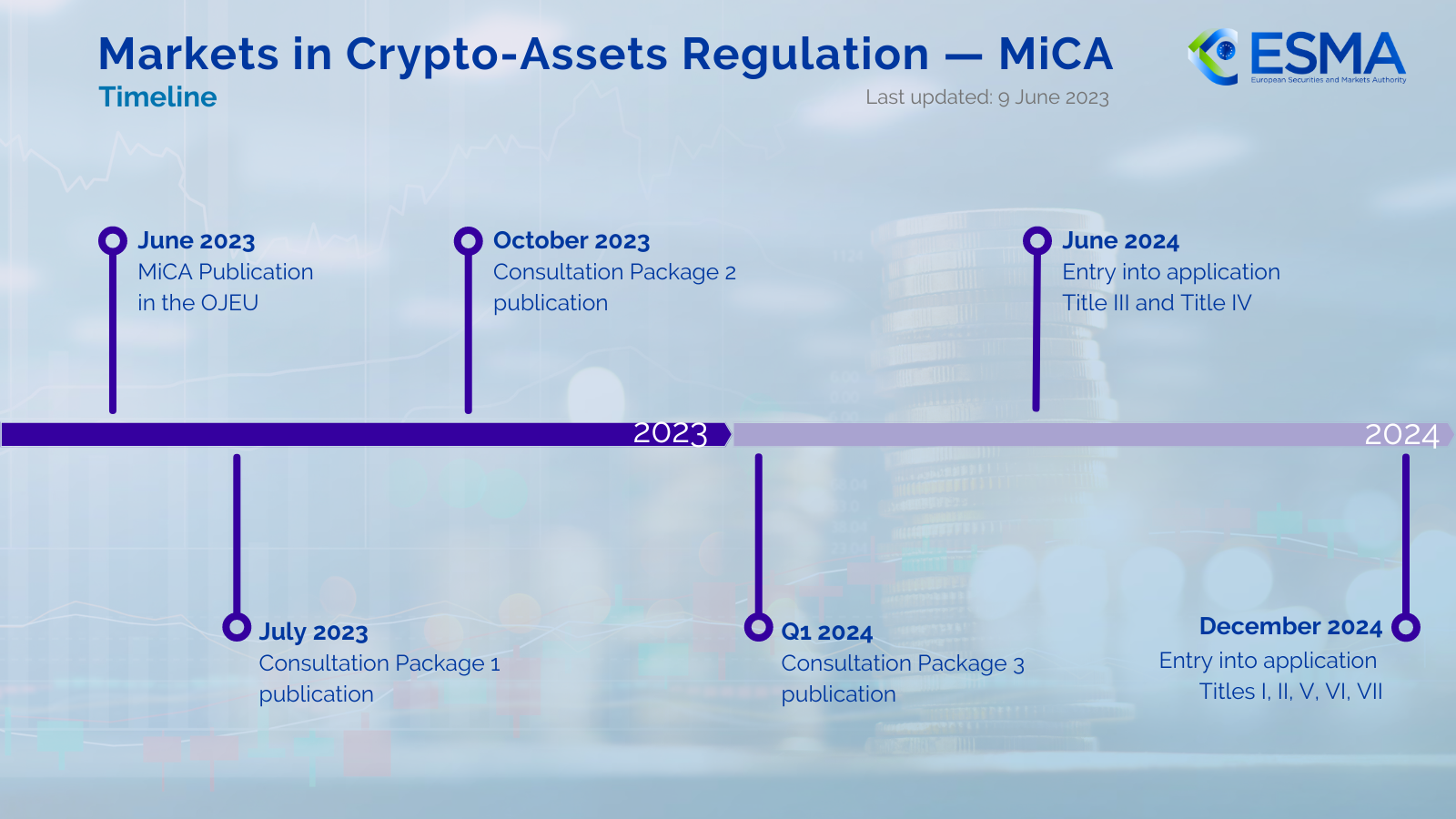

Markets in Crypto Assets (MiCA) is a proposed regulation of the European Parliament and the Council on crypto asset markets. It amends the last directive in the European Union - (EU) 2019/1937.

MiCA is part of a broader digital finance package, which also includes the DORA Act (the Digital Operational Resilience and Cyber Security in the Financial Services Sector Act) and the Pilot DLT (Distributed Ledger Technology) Regulation.

The MiCA applies to Crypto-asset Service Providers, such as:

trust portfolios;

exchanges for crypto-crypto or crypto-currency fiat transactions;

cryptocurrency trading platforms;

cryptocurrency asset advisory firms; and cryptocurrency wallet managers.

MiCA covers three types of assets:

asset reference tokens (including stablecoins backed by commodities or one or more currencies),

electronic money tokens (stablecoins backed by a single fiat currency),

other tokens, including utility tokens.

MiCA aims to unify regulations and increase security.

Changes include:

Introducing a clear definition of cryptocurrencies as a digital representation of value or rights that can be transferred and stored electronically using blockchain technology.

Under the MiCA, centralized exchanges are classified as Crypto Asset Service Providers (CASPs), and the new rules are designed to meet four primary objectives, such as:

legal certainty, i.e. the creation of uniform regulations for crypto entities;

consumer and investor protection;

support innovation;

ensure financial stability.

Entities operating under the terms of the regulation will have to comply with requirements such as being based in the EU, having no persons convicted of financial crimes on the board, and having appropriate documentation and procedures (including a business continuity and recovery plan).

The European Securities and Markets Authority will maintain a publicly accessible and divided into 2 parts register of entities: those with a license and those that have had their license revoked or never obtained it. An entry on such a list will be visible for 5 years.

After the expiration of the transition period for the introduction of the new MiCA regulations, established in the country in question on the basis of the MiCA regulations and internal legislation, existing activities within the scope of the MiCA - if they do not take steps to apply for a new MiCA-compliant license - will be deleted from the register (so, for example, in the case of the entry in the Polish Register of virtual currency activities) or stripped of their existing licenses, respectively, and thus lose their permission to conduct activities.

In order to be able to continue to carry out activities in the country covered by the MiCA regulations in which they were previously authorized to operate, it is necessary to apply for a license under the MiCA regulations.

Cada país onde operamos tem requisitos específicos que uma bolsa de moeda virtual deve cumprir para obter as licenças ou autorizações necessárias para a condução de negócios. Isto garante que está a negociar num ambiente seguro e legal.

Aqui estão os países onde operamos sob as licenças necessárias ou outras autorizações: