Download our zondacrypto: discover crypto

app and start trading now!

The Estonian legal system requires the implementation of Regulation 2023/1114 of 31 May 2023. However, the current Estonian cryptocurrency licensing system complies with legal requirements and the highest international ethical standards, effectively preventing money laundering and terrorist financing.

The company, as an AML-regulated entity in the Estonian market, is subject to audit obligations in the areas of compliance and finance before the Estonian AML regulator, the Financial Intelligence Unit. Both of these areas significantly impact the transaction security of the exchange and its users, which undoubtedly covers the scope with the Company's mandatory audits.

The aforementioned audits include:

The company reacts dynamically to legislative changes. As a result of the amendment of the Estonian AML Act, it implemented a number of internal procedures that were submitted for FIU verification. As a result of the above, zondacrypto obtained a licence upgrade. The statistics leave no illusions. As of the date of writing this article, the number of licensed entities is only 47, while the maximum number of licences granted was as high as 1,447.

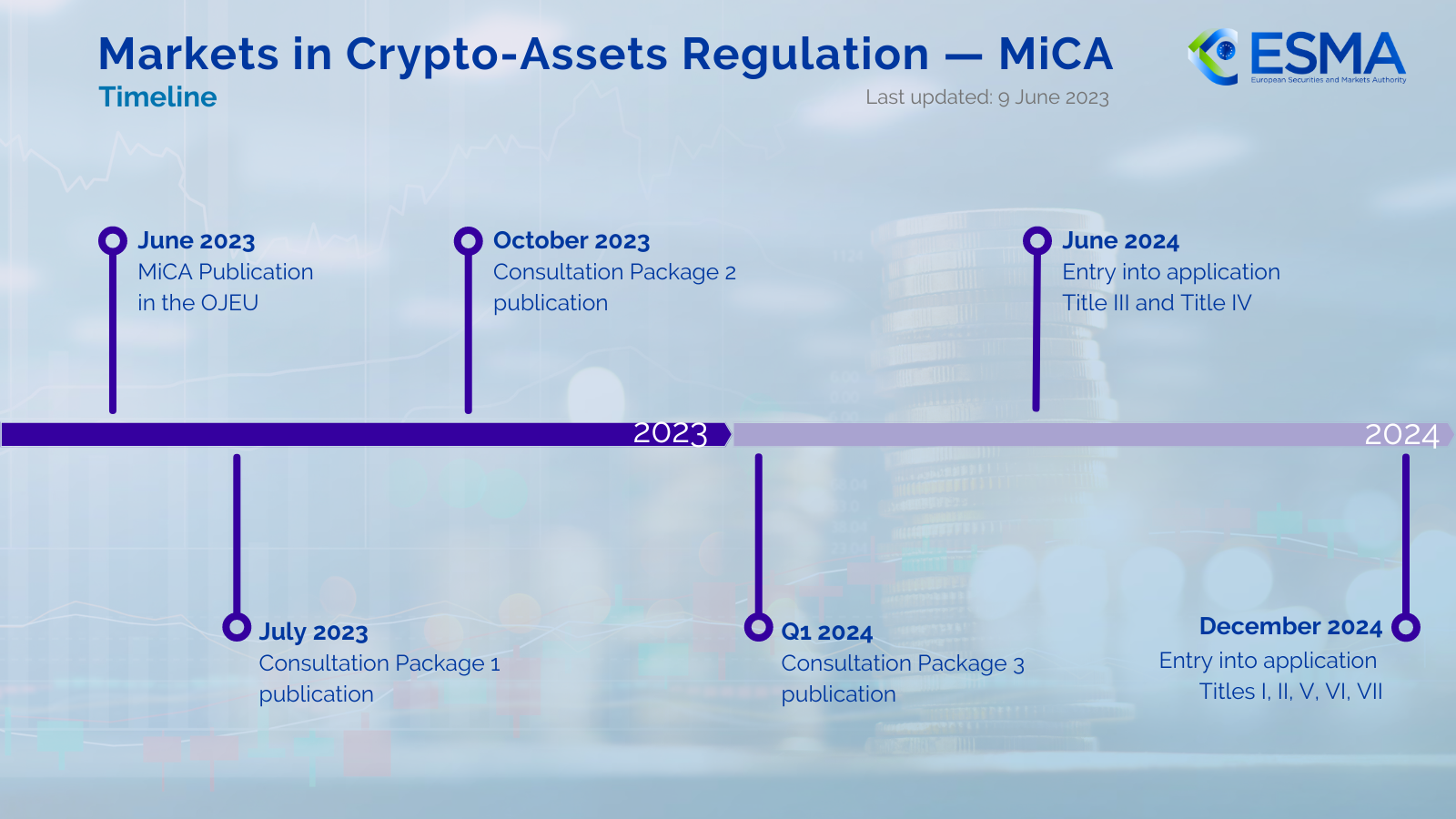

Markets in Crypto Assets (MiCA) is a proposed regulation of the European Parliament and the Council on crypto asset markets. It amends the last directive in the European Union - (EU) 2019/1937.

MiCA is part of a broader digital finance package, which also includes the DORA Act (the Digital Operational Resilience and Cyber Security in the Financial Services Sector Act) and the Pilot DLT (Distributed Ledger Technology) Regulation.

The MiCA applies to Crypto-asset Service Providers, such as:

trust portfolios;

exchanges for crypto-crypto or crypto-currency fiat transactions;

cryptocurrency trading platforms;

cryptocurrency asset advisory firms; and cryptocurrency wallet managers.

MiCA covers three types of assets:

asset reference tokens (including stablecoins backed by commodities or one or more currencies),

electronic money tokens (stablecoins backed by a single fiat currency),

other tokens, including utility tokens.

MiCA aims to unify regulations and increase security.

Changes include:

Introducing a clear definition of cryptocurrencies as a digital representation of value or rights that can be transferred and stored electronically using blockchain technology.

Under the MiCA, centralized exchanges are classified as Crypto Asset Service Providers (CASPs), and the new rules are designed to meet four primary objectives, such as:

legal certainty, i.e. the creation of uniform regulations for crypto entities;

consumer and investor protection;

support innovation;

ensure financial stability.

Entities operating under the terms of the regulation will have to comply with requirements such as being based in the EU, having no persons convicted of financial crimes on the board, and having appropriate documentation and procedures (including a business continuity and recovery plan).

The European Securities and Markets Authority will maintain a publicly accessible and divided into 2 parts register of entities: those with a license and those that have had their license revoked or never obtained it. An entry on such a list will be visible for 5 years.

After the expiration of the transition period for the introduction of the new MiCA regulations, established in the country in question on the basis of the MiCA regulations and internal legislation, existing activities within the scope of the MiCA - if they do not take steps to apply for a new MiCA-compliant license - will be deleted from the register (so, for example, in the case of the entry in the Polish Register of virtual currency activities) or stripped of their existing licenses, respectively, and thus lose their permission to conduct activities.

In order to be able to continue to carry out activities in the country covered by the MiCA regulations in which they were previously authorized to operate, it is necessary to apply for a license under the MiCA regulations.

Each country where we operate has specific requirements that a virtual currency exchange must meet to obtain the necessary licenses or authorizations for conducting business. This ensures that you are trading in a safe and legal environment.

Here are the countries where we operate under the required licenses or other authorizations: